Please find below, for your information, an excerpt from a report recently issued by S&P Market, Global Intelligence:

A look ahead to the key strategic trends and opportunities expected to drive the metals and mining industry narrative through 2022 and beyond.

“Although zinc demand in the energy transition will be a corollary to copper demand, zinc is used in renewables to protect against corrosion, and we might see some advancements in the zinc energy battery storage space. These advancements are still subject to the challenges of lower life cycle and rechargeability compared with lithium-ion batteries. The zinc price will remain elevated, however, with fewer mines expected to start up in 2022-25 — especially in China, where mined zinc is estimated to decline to 3.8 Mt within the forecast period.”

The Akie Zn-Pb-Ag Project

The 100% owned Akie property is situated within the Kechika Trough, the southernmost area of the regionally extensive Paleozoic Selwyn Basin and one of the most prolific sedimentary basins in the world for the occurrence of SEDEX zinc-lead-silver and stratiform barite deposits.

Drilling on the Akie property by ZincX Resources since 2005 has identified a significant body of baritic-zinc-lead SEDEX mineralization known as the Cardiac Creek deposit. The deposit is hosted by siliceous, carbonaceous, fine-grained clastic rocks of the Middle to Late Devonian Gunsteel Formation.

The Company updated the estimate of mineral resources at Cardiac Creek in 2018, as follows:

| 5% Zinc Cut-Off Grade | Contained Metal: | ||||||

| Category | Tonnes (million) | Zn (%) | Pb (%) | Ag (g/t) | Zn (B lbs) | Pb (B lbs) | Ag (M oz) |

| Indicated | 22.7 | 8.32 | 1.61 | 14.1 | 4.162 | 0.804 | 10.3 |

| Inferred | 7.5 | 7.04 | 1.24 | 12.0 | 1.169 | 0.205 | 2.9 |

The Company announced robust positive results from the 2018 Preliminary Economic Assessment (PEA). The PEA envisages a conventional underground mine and concentrator operation with an average production rate of 4,000 tonnes per day. The mine will have an 18-year life with potential to extend the life-of-mine (LOM) through resource expansion at depth. Key parameters for the PEA are as follows:

| Parameter | Base Case1 |

| Tonnes Mined | 25.8 Mt |

| Mined Head Grades | 7.6% Zn; 1.5% Pb; 13.08 g/t Ag |

| Tonnes Milled | 19.7 Mt |

| Milled Head Grades (after DMS2 upgrade) | 10.0% Zn; 1.9% Pb; 17.17 g/t Ag |

| Total Payable Metal (LOM) | $3,960M3 |

| Initial CAPEX | $302.3M including $45.7M contingency |

| LOM Total CAPEX | $617.9M including $58.5M contingency |

| All-in Total OPEX | $102.4 per tonne milled |

| Pre-Tax NPV7% | $649M |

| Pre-Tax IRR | 35% |

| Pre-Tax Payback | 2.6 years |

| After-Tax NPV7% | $401M |

| After-Tax IRR | 27% |

| After-Tax Payback | 3.2 years |

1. The base case used metal prices are calculated from the 3 year trailing average coupled with two year forward projection of the average price; and are: US$1.21/lb for zinc, US$1.00/lb for lead and US$16.95 for silver. A CDN$/US$ exchange rate of 0.77 was used. The NPV discount rate is 7%. 2. DMS = dense media separation. 3. All dollar amounts expressed in Canadian dollars.

The PEA is considered preliminary in nature and includes mineral resources, including inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not yet demonstrated economic viability. Due to the uncertainty that may be attached to mineral resources, it cannot be assumed that all or any part of a mineral resource will be upgraded to mineral reserves. Therefore, there is no certainty that the results concluded in the PEA will be realized.

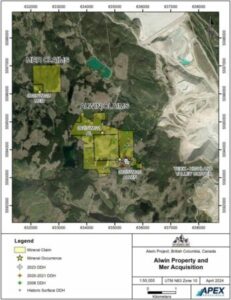

Kechika Regional Project In addition to the Akie Project, the Company owns 100% of eight of eleven large, contiguous property blocks that comprise the Kechika Regional Project including the advanced Mt. Alcock prospect. The Kechika Regional Project also includes the Pie, Yuen and Cirque East properties which the Company maintains a significant 49% interest with partners Teck Resources Limited (TSX: TECK.B) and Korea Zinc Co. Ltd holding 51%. These properties collectively extend northwest from the Akie property for approximately 140 kilometres covering the highly prospective Gunsteel Formation shale; the main host rock for known SEDEX zinc-lead-silver deposits in the Kechika Trough of northeastern British Columbia. These projects are located approximately 260 kilometres north northwest of the town of Mackenzie, British Columbia, Canada