VANCOUVER, British Columbia – May 26, 2022 – Kingfisher Metals Corp. (TSX-V: KFR) (FSE: 970) (OTCQB: KGFMF) (“Kingfisher” or the “Company”) is pleased to announce that, further to its news release dated April 27, 2022, and due to investor demand, it has upsized its non-brokered private placement (the “Offering”) from gross proceeds of up to C$3.0 million to up to C$4.9 million through the issuance of charity flow-through units at a price of C$0.28 per charity unit and flow-through units at a price of C$0.24 per FT unit of the company (collectively, the “Offered Units”).

The aggregate gross proceeds raised from the Offering will be used before 2024 for general exploration expenditures which will constitute Canadian exploration expenses (within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the “Tax Act”)), that will qualify as “flow through mining expenditures” within the meaning of the Tax Act.

All terms of the Offering remain the same, provided that the Company intends to issue up to a total of 17,891,671 Offered Units. Each Offered Unit will be comprised of one common share of the Company (each, a “Common Share”) and one-half of one common share purchase warrant (each whole warrant, a “Warrant”), with each Warrant being exercisable for one Common Share at an exercise price of C$0.35 per Common Share at any time up to 24 months following the closing date of the Offering.

In connection with the Offering, the Company may pay finder’s fees to certain finders, which fees would be a cash payment equal to up to 7% of the gross proceeds raised by purchasers introduced by such finders, and the issuance of non-transferable compensation warrants equal to up to 7% of the number of Offered Units purchased by purchasers introduced by such finders (each, a “Compensation Warrant”). Each such Compensation Warrant will be exercisable for one Common Share at an exercise price of C$0.35 per Common Share at any time prior up to 24 months following the closing date of the Offering.

The Offering is expected to close on or about June 7, 2022, and is subject to approval of the TSX Venture Exchange. All securities issued pursuant to the Offering and as payment of any finder’s fees, including Common Shares issuable upon the exercise of Warrants or Compensation Warrants, if any, will be subject to a hold period of four months and one day after the date of closing of the Offering.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Kingfisher Metals Corp.

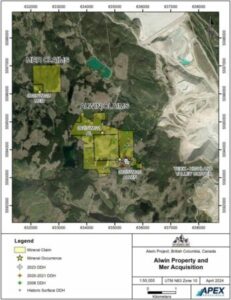

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia. Kingfisher has three 100% owned district-scale projects that offer potential exposure to high-grade gold, copper, silver, and zinc. The Company currently has 85,173,300 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 236 358 0054

E-Mail: info@kingfishermetals.com