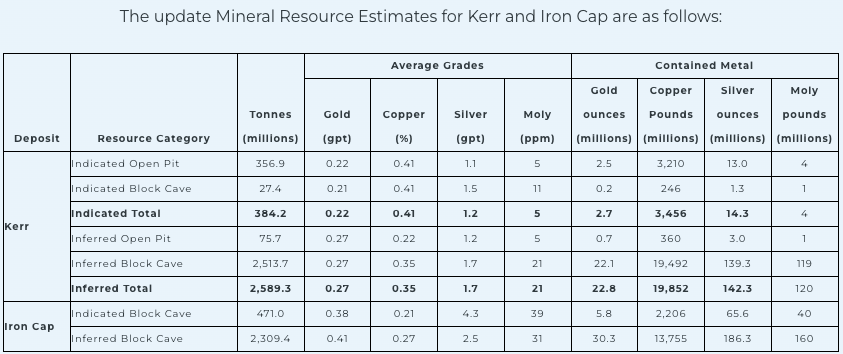

Toronto, Ontario–(Newsfile Corp. – February 5, 2024) – Seabridge Gold (TSX: SEA) (NYSE: SA) announced today updated Mineral Resource Estimates for the Iron Cap and Kerr deposits at its 100-owned KSM Project located in northwestern British Columbia. The underground block cave constraining shapes for Kerr and Iron Cap have been updated using the same metal prices used in the 2022 Mitchell and East Mitchell open pit constraining shapes (US$1,820/oz Au, US$4.20/lb Cu, US$28/oz Ag, and US$ 13.5/lb Mo at a currency exchange rate of 0.83 US$ per 1.00 CDN).

Inferred Mineral Resources increase by 5.9 Million Ounces of Gold, 3.3 Billion Pounds of Copper, 55.4 Million ounces of Silver and 51 million pounds of molybdenum.

Indicated Mineral Resources increase by 0.3 Million Ounces of Gold, 0.2 Billion Pounds of Copper, 3.5 Million ounces of Silver and 2 million pounds of molybdenum.

The updated Mineral Resource Estimates within the underground block cave constraining shapes for Kerr and Iron Cap have a mining grade shut-off applied which is appropriate for the assumed block cave mining method. This is consistent with the unselective block cave mining method used in the 2022 PEA and is different from previous Mineral Resource statements at Kerr and Iron Cap which applied a grade cut-off.

Resource models supporting the updated Mineral Resource Estimates have not changed and they are the same models used in the previous resource statement as reported in the KSM Preliminary Feasibility Study and Preliminary Economic Assessment, NI 43-101 Technical Report”, with an effective date of August 08, 2022 (see here).

Seabridge Chairman and CEO Rudi Fronk said the resource restatements reflect gains from a consistent application of metal price parameters. “As we move towards a joint venture on KSM, it makes sense to normalize our resource estimates across all of KSM’s deposits.”

Notes:

- The effective date for the Mineral Resource Estimate for Kerr and Iron Cap is January 10, 2024.

- The Mineral Resource Estimates have been verified and endorsed by Henry Kim P.Geo., an independent Qualified Person.

- Mineral Resources are reported inclusive of Mineral Reserves.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources were prepared in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May 10, 2014) and CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (Nov 29, 2019).

- Mineral Resources were constrained within mineable shapes depending on the assumed mining methods.

- The Mineral Resource for Iron Cap deposit has been constrained by conceptual block cave shapes using the following assumptions: metal prices of US$1,820/oz Au, US$4.20/lb Cu, US$28/oz Ag, and US$13.5/lb Mo at a currency exchange rate of 0.83 US$ per 1.00 CDN$; Mining cost of $5.64/t; $11/t process + G&A costs; Total operating cost used for the block cave shut-off was rounded to $16.5/t; Copper concentrate terms are 96% payable Cu; 97.8% payable Au; 90% payable Ag. Offsite costs (smelting, refining, transport, and insurance) are $281 per tonne of concentrate; doré terms are $2/oz Au offsite costs (refining, transport, and insurance), 99.8% Au payable, and 90% Ag payable; metallurgical recovery projections vary depending on metallurgical domain and metal grades and are based on metallurgical test work, average metallurgical recoveries are: 64% for gold, 87% for copper, 50% for silver and 27% for molybdenum. The block cave constraining shapes assume a maximum height of draw of 750m and minimum height of draw of 195m, and a minimum span dimension for each of the footprints of 200m.

- The Mineral Resource for Kerr deposit has been constrained by a conceptual open pit and conceptual block cave shapes below the pit.

- The Kerr pit constraining shape uses the following assumptions: metal prices US$1,300/oz Au, US$3.00/lb Cu, US$20/oz Ag, and US$9.7/lb Mo at a currency exchange rate of 0.79 US$ per 1.00 CDN$; Mining cost of $1.8/t; $9/t process + G&A costs; Copper concentrate terms are 96% payable Cu; 97.8% payable Au; 90% payable Ag. Offsite costs (smelting, refining, transport, and insurance) are $281 per tonne of concentrate; doré terms are $2/oz Au offsite costs (refining, transport, and insurance), 99.8% Au payable, and 90% Ag payable; metallurgical recovery projections vary depending on metallurgical domain and metal grades and are based on metallurgical test work, average metallurgical recoveries are: 63% for gold, 83% for copper, 53% for silver and 7% for molybdenum. The Kerr constraining pit uses an assumed pit slope of 45 degrees. A mining restriction surface was used to limit the depth of the conceptual Kerr constraining pit in order to leave a reasonable quantity of potential underground material for the Kerr block cave resource constraining shape. The pit shell does not overlap with the block cave mining shape below the pit.

- The Kerr block cave constraining shapes use the following assumptions: metal prices of US$1,820/oz Au, US$4.20/lb Cu, US$28/oz Ag, and US$ 13.5/lb Mo at a currency exchange rate of 0.83 US$ per 1.00 CDN$; Mining cost of $6.82/t; $11/t process + G&A costs; Total operating cost used for the block cave shut-off was rounded to $18/t; Copper concentrate terms are 96% payable Cu; 97.8% payable Au; 90% payable Ag. Offsite costs (smelting, refining, transport, and insurance) are $281 per tonne of concentrate; doré terms are $2/oz Au offsite costs (refining, transport, and insurance), 99.8% Au payable, and 90% Ag payable; metallurgical recovery projections vary depending on metallurgical domain and metal grades and are based on metallurgical test work, average metallurgical recoveries are: 55% for gold, 88% for copper, 49% for silver and 17% for molybdenum. The block cave constraining shapes assume a maximum height of draw of 750m and minimum height of draw of 195m, and a minimum span dimension for each of the footprints of 200m.

- All material within the block cave constraining shapes have been reported in the Mineral Resource statements using a shut-off approach as block caving is a non-selective mining method.

- Net Smelter Return (NSR) cut-off is $9/t for the Kerr open pit using the following assumptions: metal prices of US$1,300/oz Au, US$3.00/lb Cu, US$20/oz Ag, and US$ 9.7/lb Mo at a currency exchange rate of 0.79 US$ per 1.00 CDN$; Copper concentrate terms are 96% payable Cu; 97.8% payable Au; 90% payable Ag. Offsite costs (smelting, refining, transport, and insurance) are $281 per tonne of concentrate; doré terms are $2/oz Au offsite costs (refining, transport, and insurance), 99.8% Au payable, and 90% Ag payable; metallurgical recovery projections vary depending on metallurgical domain and metal grades and are based on metallurgical test work with average metallurgical recoveries of: 63% for gold, 83% for copper, 53% for silver and 7% for molybdenum.

- “Moly” = “Molybdenum”

- Numbers may not add due to rounding.

- Unless noted otherwise, dollars reported herein are Canadian dollars.

The mineral resources within the 2022 PEA mine plans for Kerr and Iron Cap are subsets of, and consistent with, the updated Mineral Resources, and the mineral resources within the PEA mine plan are not impacted by the updated underground block cave constraining shapes.

The changes to the Mineral Resources are not a result of any changes to the resource models, but rather using a shut-off grade strategy for the Kerr and Iron Cap underground resources and aligning the metal price assumptions for the constraining shapes with other deposits on the KSM Project. The 2022 PEA mine plan is a subset to the mineral resources at Kerr and Iron Cap and is not impacted by the change to Mineral Resources. The increased mineral resources compared to the previous estimate would only be mined after the 33 years of mine life based on the open pit Mineral Reserves. Any future cash flows resulting from these additional mineral resources is not considered material. The change in Mineral Resource is considered not material to the KSM Project or to Seabridge Gold.

Updated Mineral Resources and the unchanged Mineral Reserves for the full KSM property are appended to the end of this news release and can be viewed on the Seabridge website at www.seabridgegold.com and here.

Qualified Persons

Henry Kim P.Geo., the independent Qualified Person and Principal Resource Geologist with Wood Canada Limited, has reviewed and approved the scientific and technical information contained in this press release. Details of the data verification performed to support the Mineral Resource estimates, and identification of any known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources are provided in Technical Report dated August 8, 2022.

About Seabridge Gold

Seabridge holds a 100% interest in several North American gold projects. Seabridge’s principal asset, the KSM project, and its Iskut projects are located in Northwest British Columbia, Canada’s “Golden Triangle”, the Courageous Lake project is in Canada’s Northwest Territories, the Snowstorm project in the Getchell Gold Belt of Northern Nevada, and the 3 Aces project is in the Yukon Territory. For a full breakdown of Seabridge’s Mineral Reserves and Mineral Resources by category please visit the Seabridge’s website at http://www.seabridgegold.com.